Automotive Industry - Crisis or Reinvention?

In the last several years, the automotive industry has been undergoing a series of significant transformations: from interior touchscreens and autonomous driving assistance features, which are now standard even in low-cost cars, to sophisticated software architectures that today act as the brain of any modern vehicle. There is another transformation happening right now: more and more cars are becoming fully electric. This is the aspect I want to briefly explore in this article.

The first steps in the transition to Electric Vehicles (EVs) and their popularisation were made in the late 2000s, when Tesla introduced its first electric cars. However, the noticeable acceleration of electrification began around 5–7 years ago, when EVs stopped being rare guests on our roads and started to become increasingly common. Today, almost every major OEM has at least one electric car in its portfolio. However, not everything is going smoothly in this transition towards EVs. So, what are the main challenges facing the automotive industry?

COVID-19 impact.

Before the 2020s, prospects for fast EV adoption looked quite promising; however, the pandemic disrupted these plans. First and foremost, global car sales dropped drastically during COVID-19. Factories were shut down and shipping was stopped, which disrupted supply chains and led to component shortages. In addition, when the pandemic ended, many companies lacked sufficient staff and resources to restart production quickly.

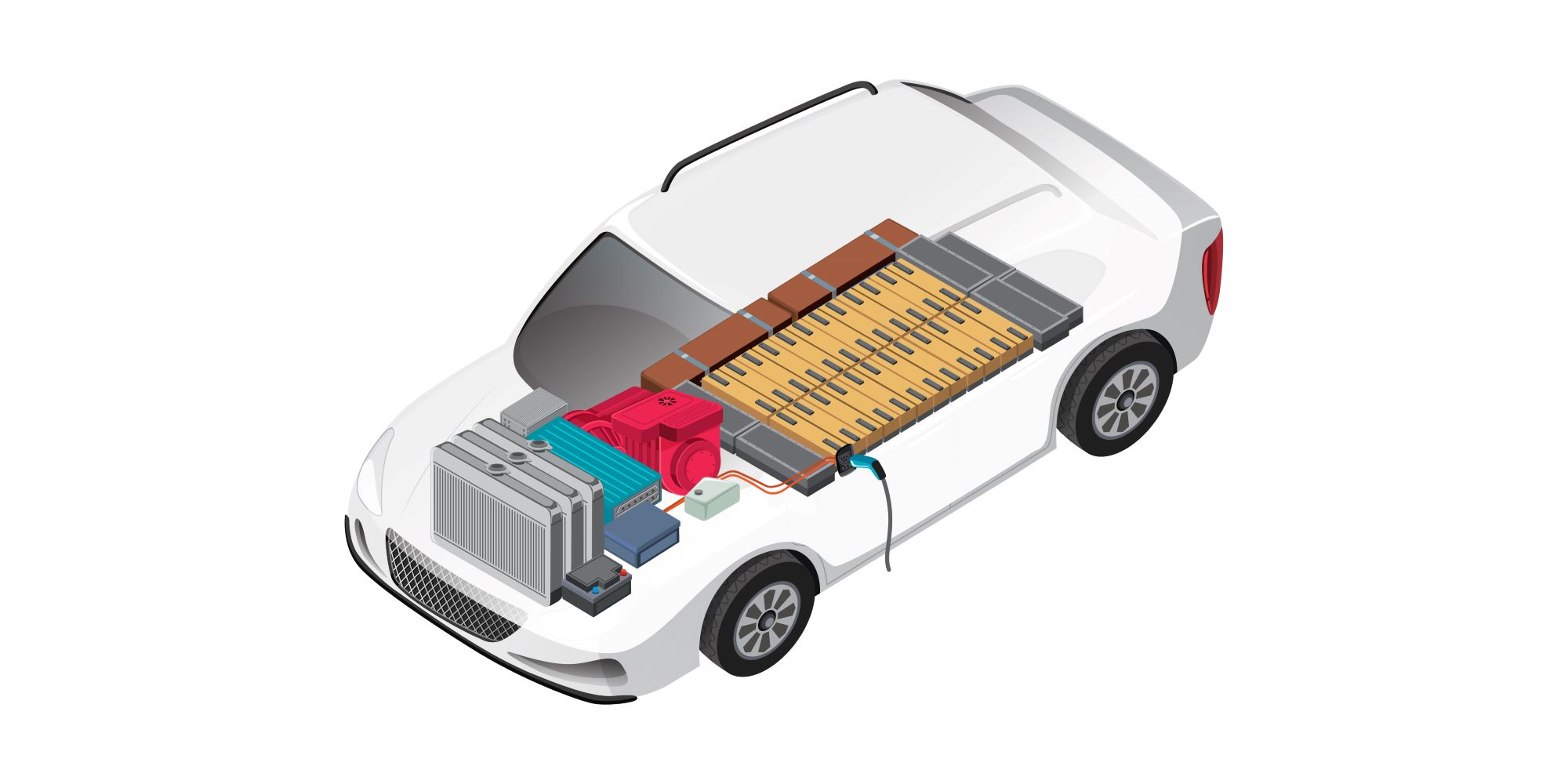

Designing and production of EVs.

At its core, an electric car is a four-wheel vehicle with an electric motor powered by a battery pack. There is no combustion engine or conventional transmission, which major OEMs had mastered over the course of the last century. As a result, manufacturers effectively have to reinvent not only the car, but large parts of the automotive industry itself. Another key element is the digitalisation of modern vehicles. We live in a digital world: almost every device we use is now “smart” and, with the help of software, can perform multiple tasks. Cars are no exception. What previously revolved around mechanics — combustion engines and transmissions — now revolves around electric motor, battery pack and software. Developing a vehicle software architecture that connects many electronic control units and modules is far from trivial. It requires thousands of experienced engineers, and millions of lines of code that must be written and then tested in real-world scenarios. You can imagine how time consuming and costly this process is.

Electric cars infrastructure.

With an average driving range of around 450 km, long-distance travel in an electric car still requires careful planning, particularly with respect to charging stations. Today, the average charging time at a motorway fast-charging station is around 30–40 minutes — assuming the station is available and not busy. This inevitably adds time to long journeys. Charging technologies and battery chemistries are constantly improving, and new ultra-fast charging stations can charge a battery to around 80% in roughly 20 minutes. However, such infrastructure is not yet widespread. More charging stations need to be built, and this again takes time and significant investment.

Trade restrictions & geopolitical uncertainties.

Trade tensions between the US and China in recent years have made it harder for suppliers to rely on long-established partners, particularly for raw materials and components that are primarily sourced from China. This has put additional pressure on many companies, making it even harder to enter or expand within the automotive sector. Some technologies are not yet broadly developed in Europe or the US — for example, the production of neodymium permanent magnets, which are critical for electric motors, regenerative braking systems and other EV electronics. As a result, OEMs increasingly require fast, proven solutions. They are less willing to invest in long-term R&D unless it is directly linked to innovation and customer-visible technologies.

Price of EVs.

Last, but not least, is the price of electric vehicles themselves. Battery pack cost remains one of the main barriers to affordable electric vehicles. An interesting fact is that battery pack prices have dropped significantly over the last decade. According to estimates from the U.S. Department of Energy, the average cost of a lithium-ion battery pack for light-duty EVs fell by about 90% between 2008 and 2023, from roughly $1,415 per kilowatt-hour(kWh) in 2008 to around $139/kWh in 2023 (adjusted for inflation). This reduction is the result of technological improvements, economies of scale and increased manufacturing volumes. Looking ahead, many analysts predict that battery costs could fall further with continued improvements in battery production technologies and the introduction of new solid-state batteries (SSBs). However, despite this significant cost reduction and even with government incentives, EVs remain relatively expensive compared to cars with internal combustion engines, which continues to limit mass adoption. OEMs are therefore constantly trying to reduce overall vehicle costs, often by limiting R&D investment in less critical components and reusing existing modules across multiple models. While this strategy helps control costs, it can have a negative impact on some suppliers.

Final thoughts.

How long will the industry remain in this state? It is hard to predict, but many experts suggest that uncertainty may continue for the next 2–3 years, with the entire 2020s likely to be a transition decade. Which companies and suppliers will survive this shift? Most likely those that adapt faster to the new environment and will be able to overcome the challenges outlined above.

Links: